What is Margin Trading? How to use Margin Trading on Binance

Binance, one of the world's leading cryptocurrency exchanges, offers margin trading to users looking to maximize their market opportunities. This guide will explain what margin trading is and how to use it effectively on Binance.

What is Margin Trading

Margin trading is a method of trading assets using funds provided by a third party. When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. Still, margin trading is also used in stock, commodity, and cryptocurrency markets.In traditional markets, the borrowed funds are usually provided by an investment broker. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Although less common, some cryptocurrency exchanges also provide margin funds to their users.

How to use Margin Trading on Binance App

With Binance Margin Trading, you can borrow funds to perform leveraged trading. Follow 4 easy steps to complete margin trading within a minute.Margin trading supports both [Cross Margin] and [Isolated Margin] Mode.

See the guide below to get started with margin trading on the Binance App

Isolated Margin User Guide (Web)

1. Trading

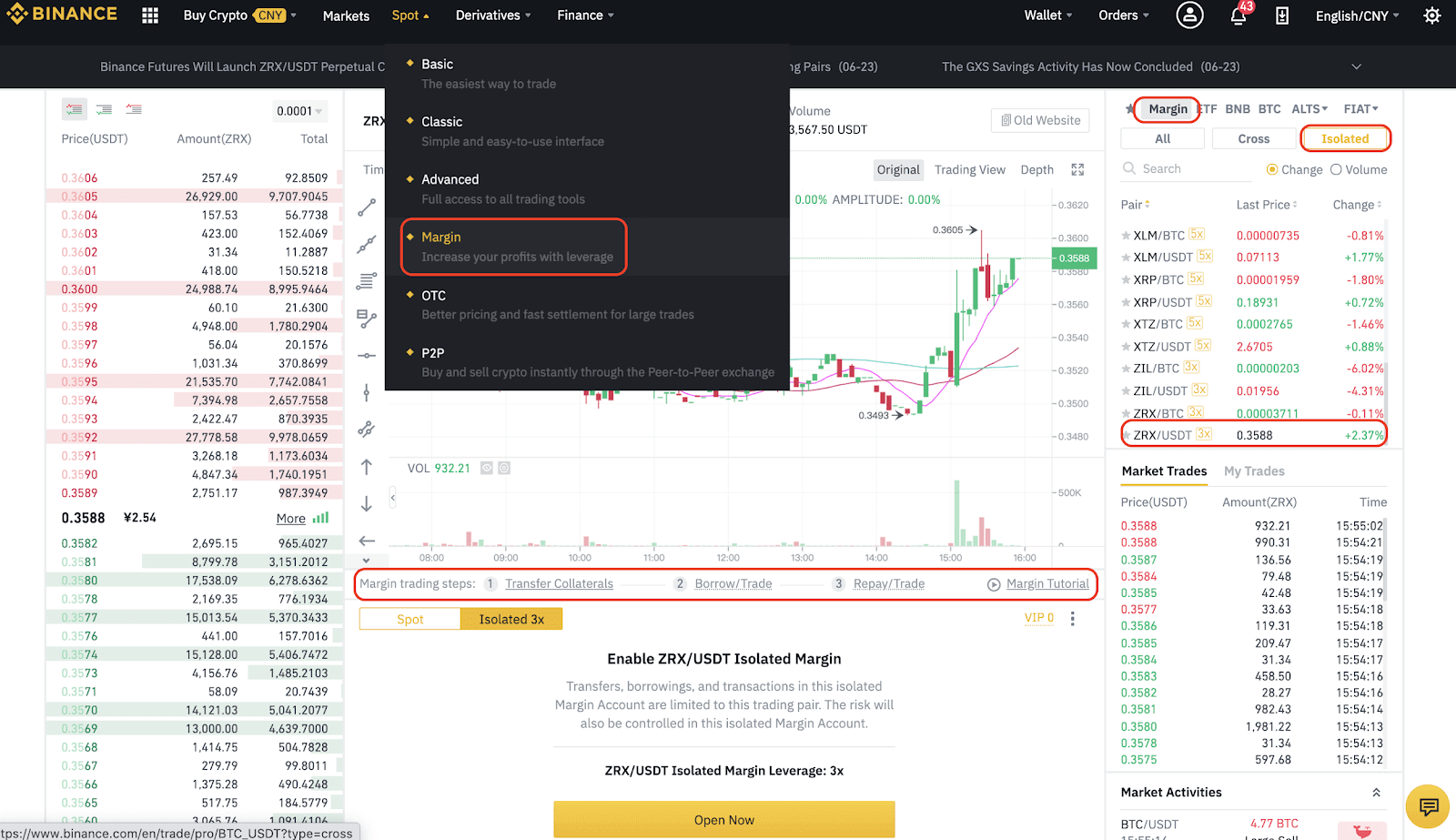

1.1 LoginLog in to the main Binance website at https://www.binance.com/. In the menu at the top of the page, go to [Spot] - [Margin] to navigate to the Margin trading interface. Click [Isolated] in the menu on the right and select your desired trading pair (such as ZRXUSDT for example).

Note: You can refer to the [Margin Trading Steps] or [Margin Tutorial] videos found in the middle of the trading interface page to learn more about Margin trading.

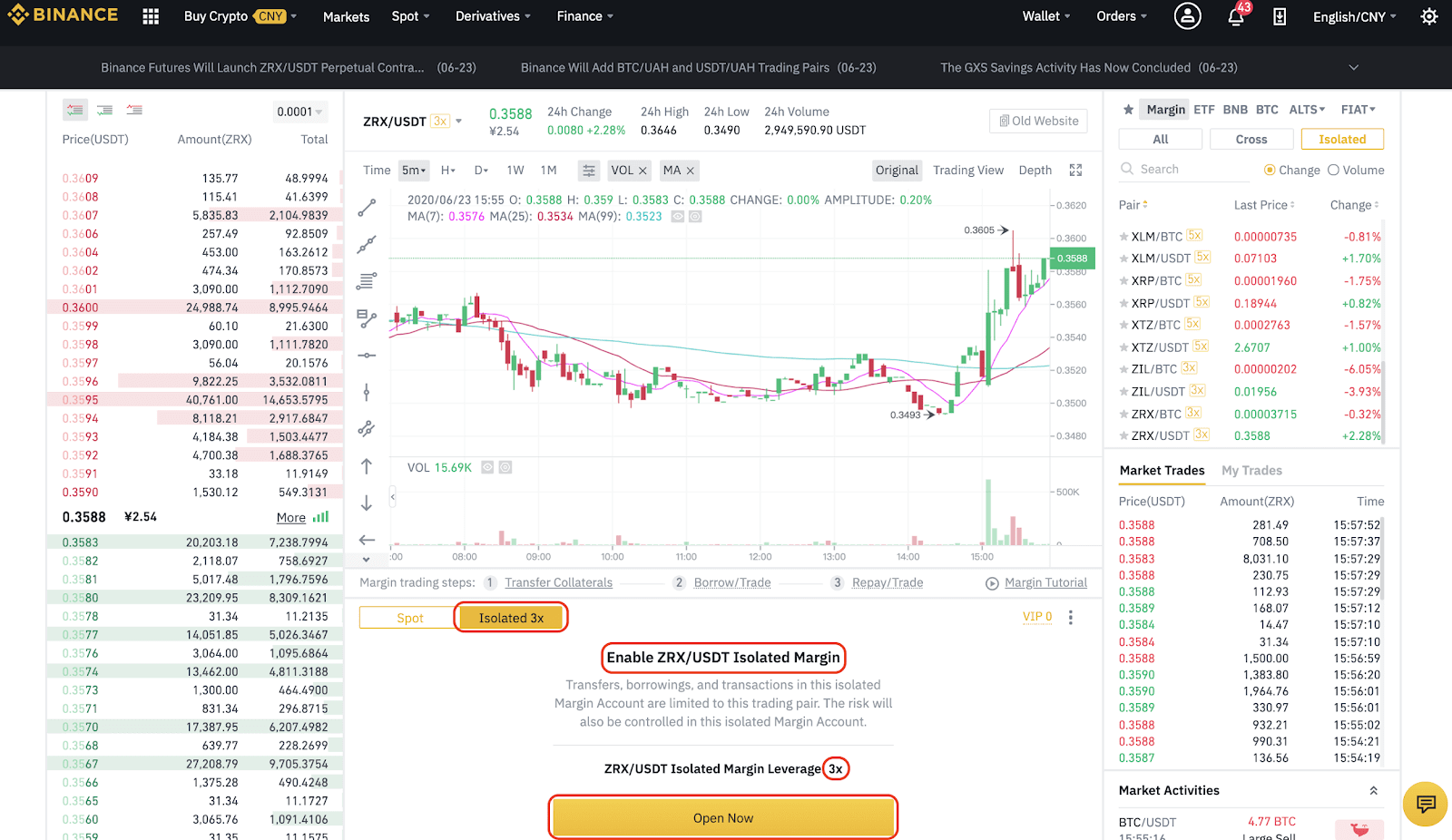

1.2 Activation

In the trading interface, confirm the trading pair and margin rate, read the Terms of Service, then click [Open Now].

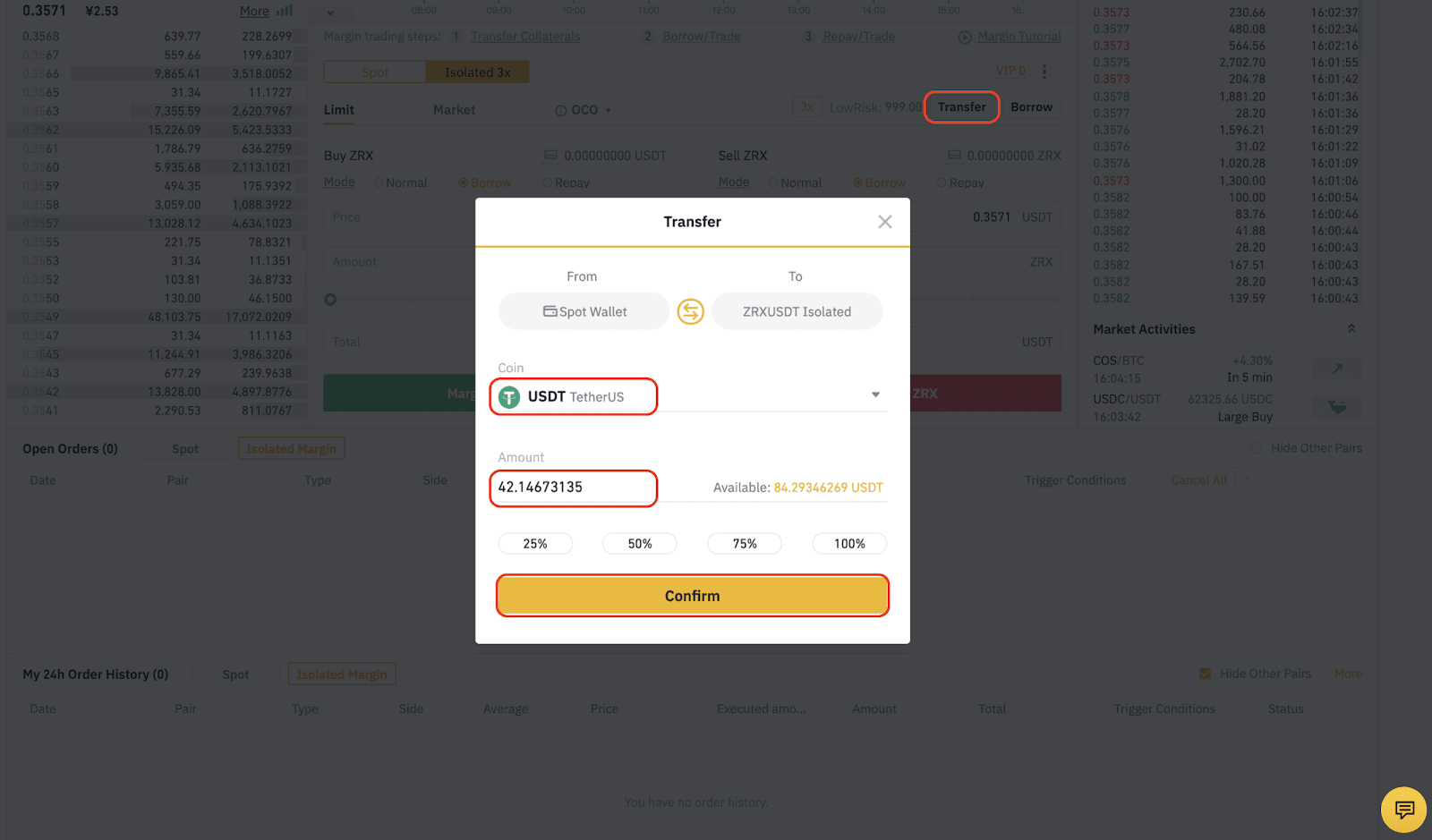

1.3 Transfer

In the trading interface, click [Transfer] on the right-hand side of the page.

In the Transfer pop-up window, confirm that you are transferring from your [Spot Wallet] to an Isolated Margin account, such as [ZRXUSDT Isolated]. Select the [Coin] and input the [Amount] and click [Confirm].

Note: Click ? to switch between [ZILBTC Isolated] and [Spot Wallet].

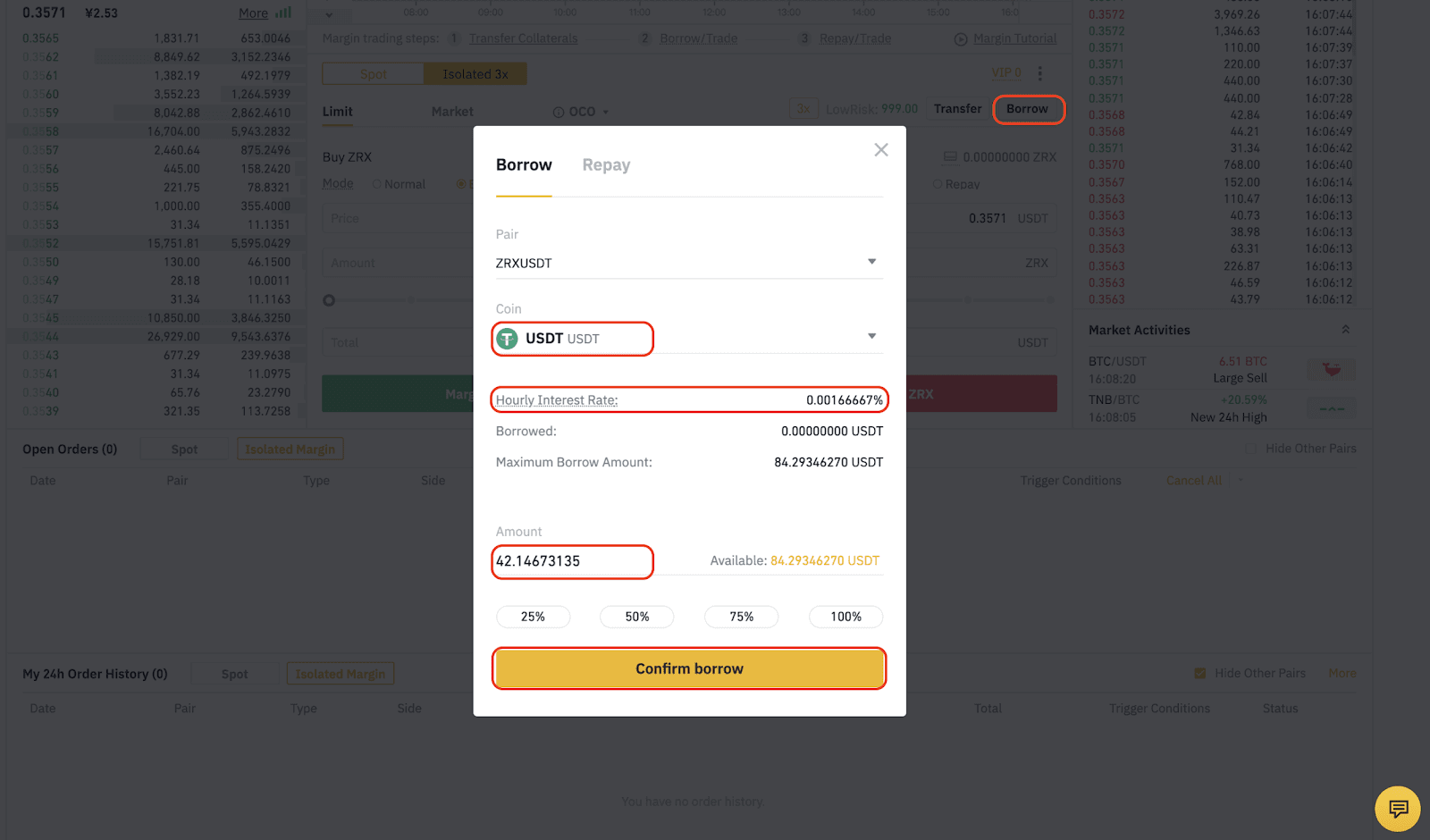

1.4 Borrowing

In the trading interface, click [Borrow] on the right-hand side of the page.

In the Borrow/Repay pop-up window, select the [Coin] and input the [Amount], then click [Confirm Borrow].

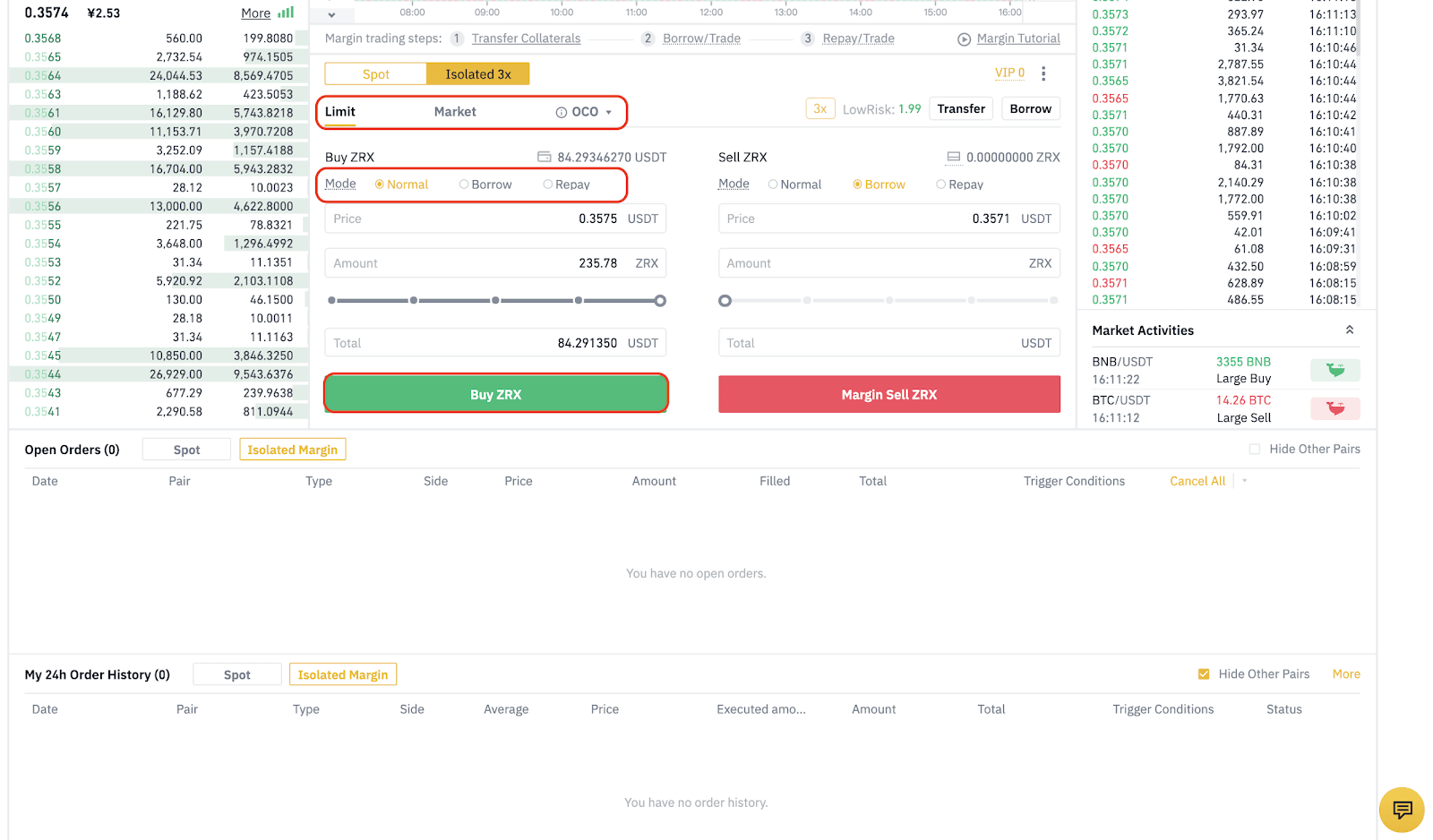

1.5 Trading

In the trading interface, select the order type by clicking [Limit], [Market], [OCO], or [Stop-limit]. Select [Normal] trading mode; input the [Price] and [Amount] you want to buy, then click [Buy ZRX].

Note: In the trading interface, you can merge borrowing + trading or trading + repayment by selecting [Borrow] or [Repay] mode when you [Margin Buy ZRX] or [Margin Sell ZRX].

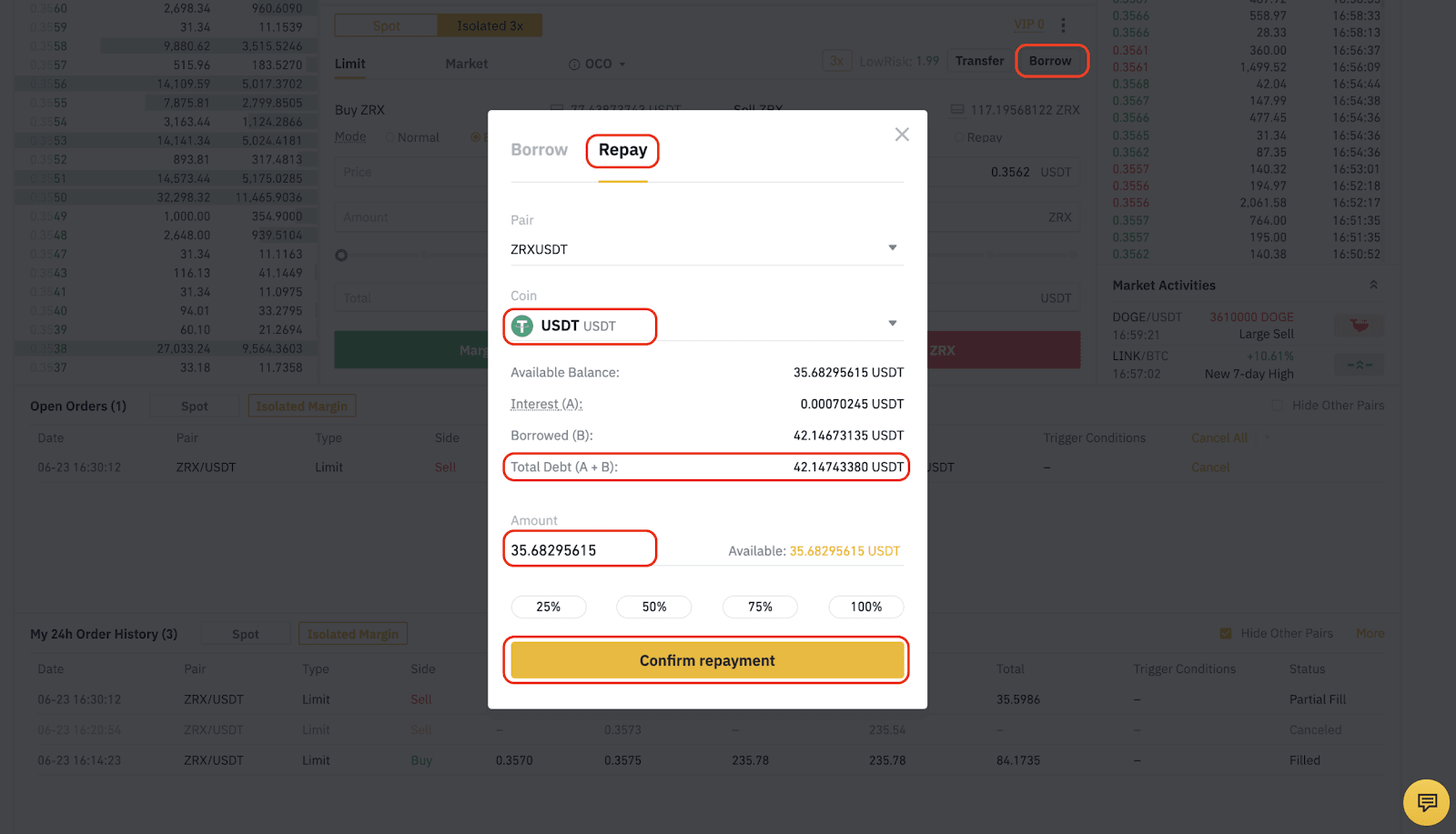

1.6 Repayment

After realizing profits, its time to repay the debt (borrowed amount + interest). In the trading interface, click [Borrow] on the right-hand side of the page, just like before.

In the Borrow/Repay pop-up window, switch to the [Repay] tab page, select the [Coin] and input the [Amount] that needs to be repaid, and click [Confirm repayment].

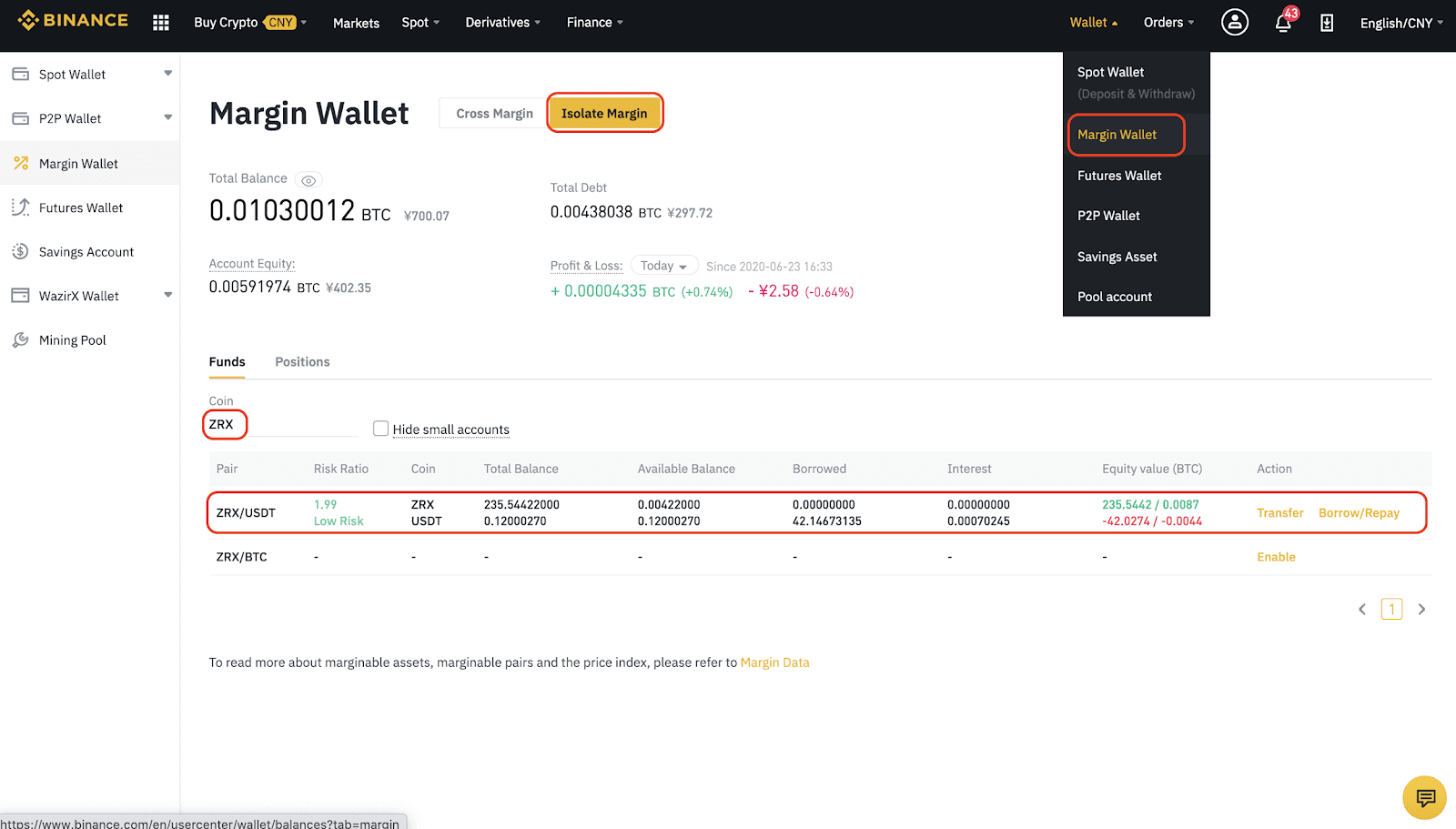

2. Wallet

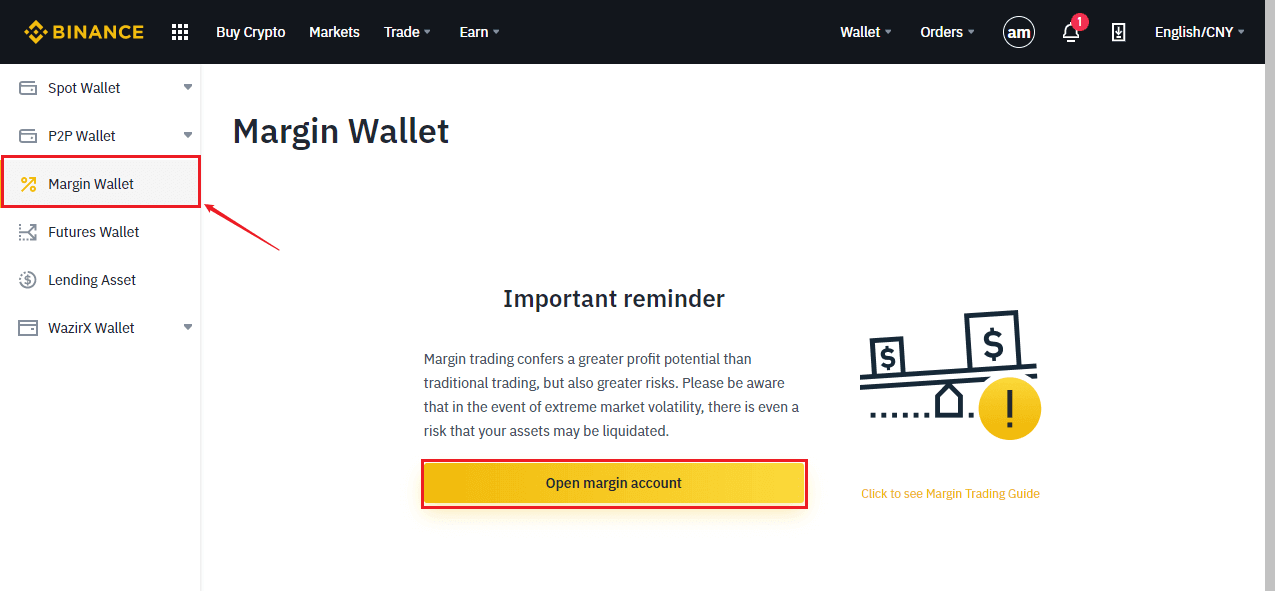

Go to the Margin Account interface by navigating to [Wallet] - [Margin Wallet] in the drop-down menu at the top of the page.Select [Isolated Margin] and enter a [Coin] (such as ZRX) to filter the trading pairs. Here you can view your assets and liabilities.

Note: In the Margin Account interface, you can also view your assets, liabilities, and earnings under [Positions].

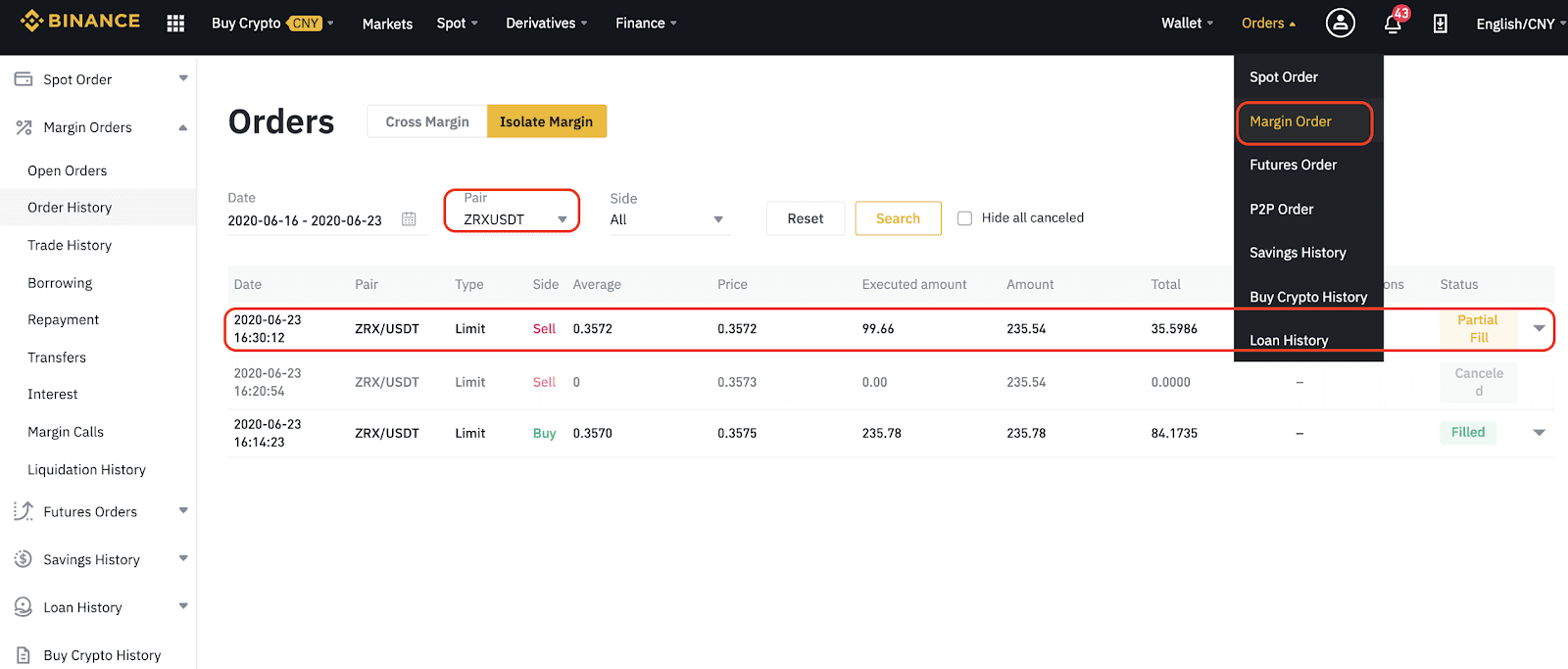

3. Orders

Enter the Margin Order interface through [Orders] - [Margin Order] in the drop-down menu at the top of the page.Select [Isolated Margin] to view your Order History. You can filter trading pairs by [Date], [Pair] (such as ZRXUSDT), and [Side].

Note: In the Margin Orders interface, you can also view your [Open Orders], [Trade History], [Borrowing], [Repayment], [Transfers], [Interest], [Margin Calls], and [Liquidation History], etc.

Margin Trading Express Guideline

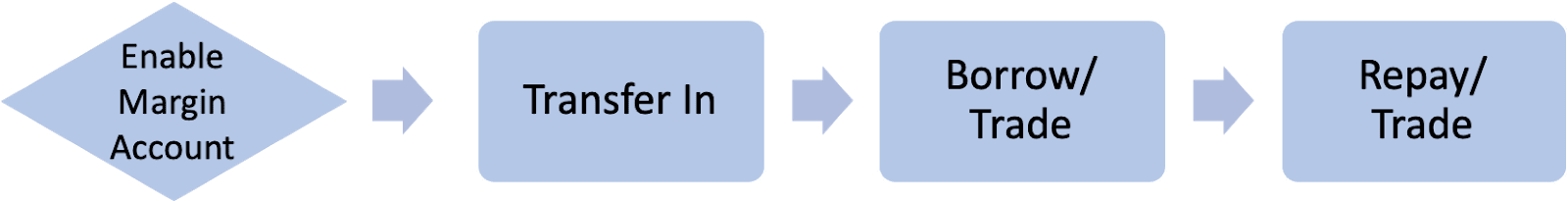

Four steps for margin trading:

Step 1: Enable margin account

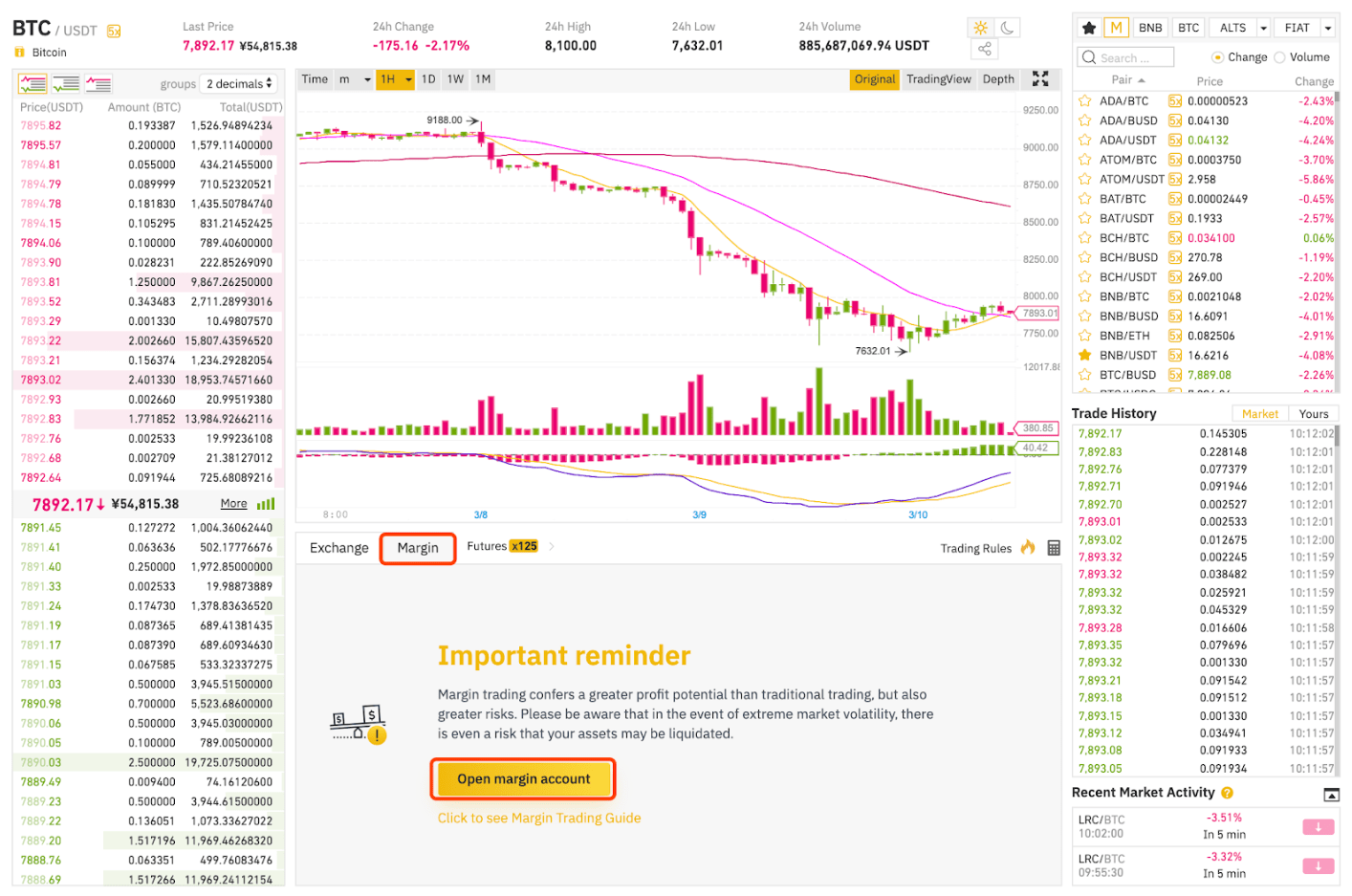

Choose [Trade] →[Basic] at the navigation panel, select [Margin] tab at any margin trading pair, then click [Open margin account].mceclip0.png

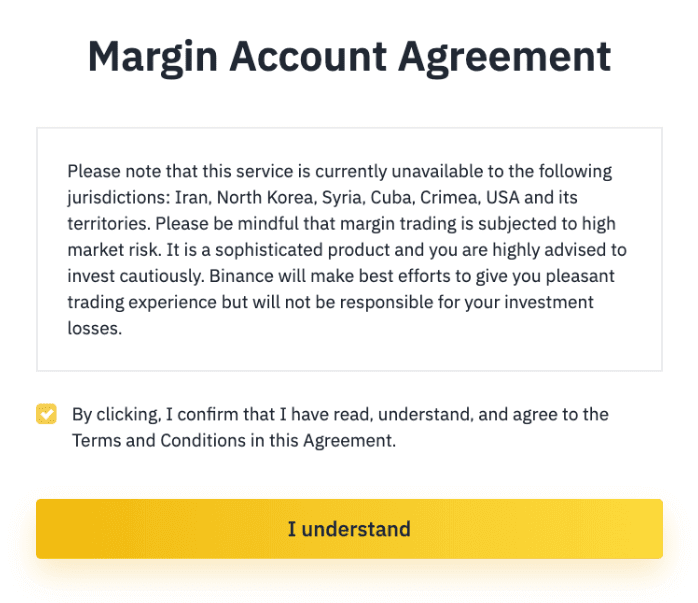

Enable the margin account by clicking [I understand] after reading the Margin Account Agreement.

Step 2: Transfer in

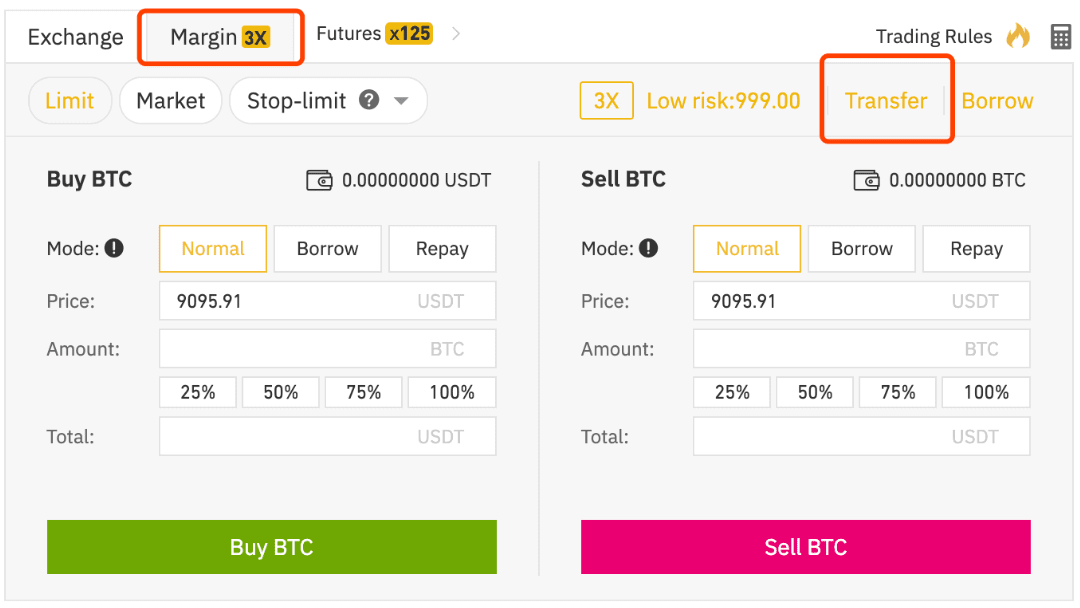

Select [Transfer] to transfer from spot wallet to margin wallet.

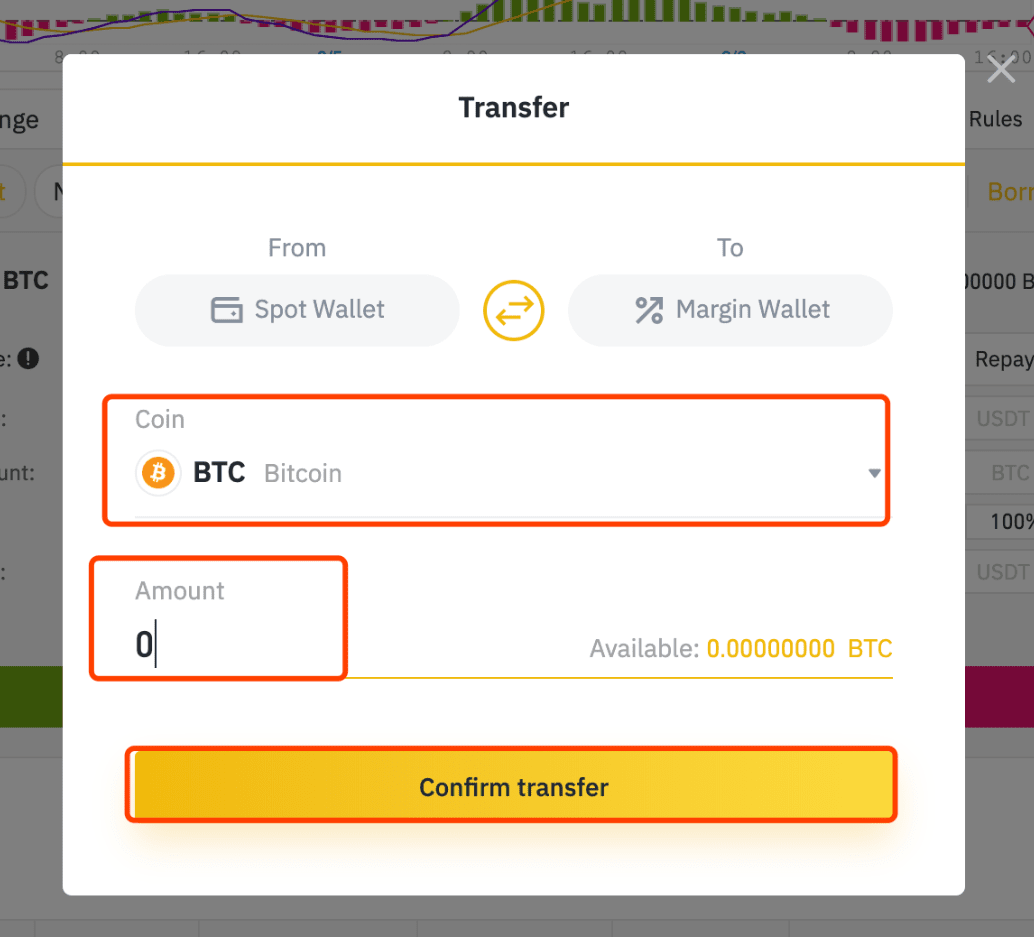

Select the coin you want to transfer, enter the amount and click [Confirm transfer] to transfer.

Step 3: Borrow/ Trade

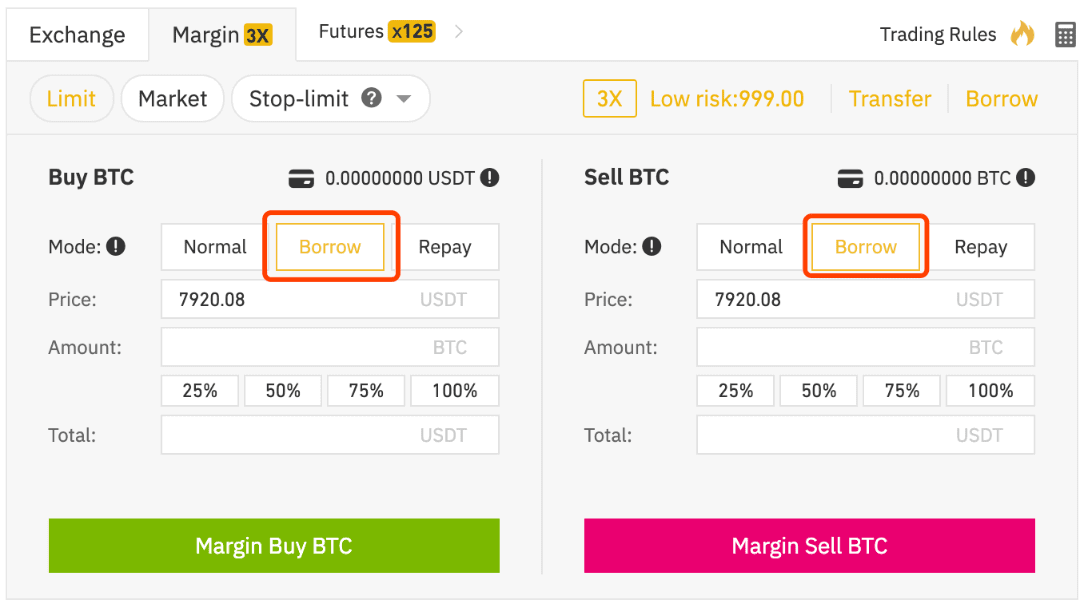

Select [Borrow] to perform Margin Buy or Margin Sell.

Step 4: Repay/ Trade

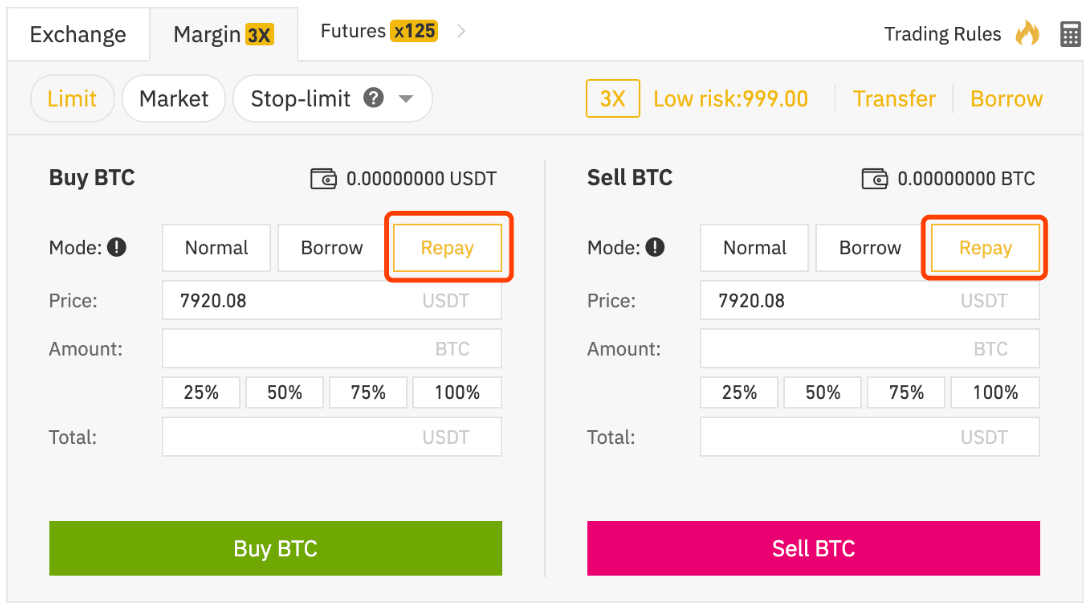

Select [Repay] to perform Margin Buy or Margin Sell.

How to enable a Margin Account on Binance

To enable a Margin account on Binance, log into your Binance account, and click on [Wallet] - [Margin Wallet].For the safety and security of your account, its necessary to enable at least one 2 Factor Authentication (2FA) method.

Notes:

- At least 10 sub-accounts can open a margin account

- Users can only borrow up to one BTC estimated asset under 5X leverage.

- Sub-accounts cannot adjust the margin leverage to 5X

Binance Margin Level and Margin Call

1. Margin level of Cross Margin

1.1 Users participating in Margin Loans may use the net assets in their Cross Margin Accounts in Binance as the Collateral, and the digital assets in any other accounts are not included in the Margin for cross-margin trading.

1.2 The Margin Level of a Cross Margin Account = Total Asset Value of a Cross Margin Account/(Total Liabilities + Outstanding Interest), where:

Total Asset Value of a Cross Margin Account = current total market value of all digital assets in the Cross Margin Account

Total Liabilities = the current total market value of all outstanding Margin Loans in the Cross Margin Account

Outstanding Interest = the amount of each Margin Loan * the number of hours as loan time by the time of calculation * hourly interest rate - deduction/paid interest.

1.3 Margin level and related operation

-

Leverage 3x

When your margin level>2, you can trade borrow, and transfer assets to the exchange wallet;

When 1.5<margin level≤2, you can trade and borrow, but you can’t transfer funds out of your margin account;

When 1.3<margin level≤1.5, you can trade, but you can’t borrow, nor transfer funds out of your margin account;

When 1.1<margin level≤1.3, our system will trigger a margin call and you will receive a notification through mail, SMS, and website to inform you to add more collateral (transfer in more collateral assets) to avoid the liquidation. After the first notification, the user will receive the notification within 24 natural hours.

When the margin level≤1.1, our system will trigger the liquidation engine and all assets will be liquidated to pay back the interest and loan. The system will send you a notification through mail, SMS and website to inform you that.

-

Leverage 5x (only supported in the master account)

When your margin level>2, you can trade borrow, and transfer assets to the spot wallet;

When 1.25<margin level≤2, you can trade and borrow, but you can’t transfer funds from your margin account to your exchange wallet;

When 1.15<margin level≤1.25, you can trade, but you can’t borrow, nor transfer funds from your margin account to your exchange wallet;

When 1.05<margin level≤1.15, our system will trigger a margin call and you will receive a notification through mail, SMS, and website to inform you to add more collateral (transfer in more collateral assets) to avoid the liquidation. After the first notification, the user will receive the notification within 24 natural hours.

When the margin level≤1.05, our system will trigger the liquidation engine and all assets will be liquidated to pay back the interest and loan. The system will send you a notification through mail, SMS and website to inform you that.

2. Margin level of Isolate Margin

2.1 The net assets in the user‘s isolated margin account only can be used as collateral in the corresponding account, and the assets in the user’s other accounts(cross margin account or other isolated accounts) couldn’t be calculated as collateral for it.

2.2 The margin level of the isolated account = the total value of assets under the isolated account / (total value of liabilities + unpaid interest)

Among them, the total value of assets = the total value of the underlying assets + nominal assets in the current isolated account

Total liabilities = The total value of the assets that have been borrowed but not returned in the current isolated account

Unrepaid interest = (the amount of each loaned asset * the time length of the loan * hourly interest rate)- repaid interest

2.3 Margin Level and Operation

When the Margin Level (hereinafter referred to as ML) 2, users can trade, can borrow, and the excess assets in the account can also be transferred to other trading accounts. But the ML still needs to be equal or greater than 2 after transferring out to ensure normal asset transferring out functions.

-

Initial Ratio (IR)

IR is the initial risk rate after the user borrows, and there are different IRs according to different leverage. For example, the IR will be 1.5 under the 3x leverage with full borrowing, the IR will be 1.25 under 5x leverage with full borrowing and the IR will be 1.11 under 10X leverage with full borrowing.

-

Margin Call Ratio ( MCR )

When MCR

The MCR will be different according to different levers. For example, the MCR for a 3x leverage is 1.35, for 5x leverage, it will be 1.18, and for 10x, it will be 1.09.

-

Liquidation Ratio (LR )

When LR

When ML ≤ LR, the system will execute the liquidation process. The assets held in the account will be forced to sell to repay the loan. At the same time, users will be notified via email, SMS, and website reminders.

LR will vary according to different leverages. For example, the LR for 3x leverage is 1.18, for 5x leverage, it is1.15 while for 10x leverage, it is 1.05.

Margin Trading Index Price

The Margin Trading Price Index is calculated in the same way as the Futures Contract Price Index. The Price Index is a bucket of prices from the major spot market exchanges, weighted by their relative volume. The Margin Trading Price Index is based on the market data of Huobi, OKEx, Bittrex, HitBTC, Gate.io, Bitmax, Poloniex, FTX, and MXC.

We also take additional protective measures in order to avoid poor market performance caused by interruptions in Spot Market Prices and connectivity problems. These protective measures are as follows:

-

Single price source deviation: When the latest price of a particular exchange deviates more than 5% from the median price of all sources, the price weight of that exchange will be set to zero temporarily.

-

Multi-price source deviation: If the latest price of more than 1 exchange shows a deviation greater than 5%, the median price of all sources will be used as the index value instead of the weighted average.

-

Exchange connectivity problem: If we can’t access the data feed of an exchange that has had trades updated in the last 10 seconds, we will consider the last and most recent price data available to calculate the price index.

-

If an exchange has no transaction data updates for 10 seconds, the weight of this exchange will be set to zero when calculating the weighted average.

-

Latest Transaction Price Protection: When the "Price Index" and "Mark Price“ matching system is unable to secure a stable and reliable source of reference data, the index will be affected for contracts with a single price index, (i.e. the Price Index will not change). In this case, we use our “Latest Transaction Price Protection" mechanism to update the Mark Price until the system is back to normal. The “Latest Transaction Price Protection” is a mechanism that temporarily switches the Mark Price to match the latest transaction price of the contract, which is used to calculate unrealized profit and loss and liquidation call level. Such a mechanism helps prevent unnecessary liquidation.

Notes

-

Cross rate: For indexes without direct quotations, the cross rate is calculated as the composite price index. For example, when combining LINK/USDT and BTC/USDT to calculate LINK/BTC.

-

Binance will update the price index components from time to time.

How long on Margin Trading

“Long”, it’s when you buy at a low price and then sell at a higher price. In this way, you can earn a profit from the price difference.

Click the video and learn how to long on margin trading.

How to short on Margin Trading

Click the video and learn how to short on margin trading.

Conclusion: Trade Responsibly with Margin on Binance

By following the correct steps and implementing risk control measures, traders can effectively use margin trading to enhance their market strategies while protecting their investments. Always trade responsibly and only use leverage that aligns with your risk tolerance.