How to Trade Crypto on Binance

This guide will walk you through the essential steps to start trading on Binance, from account setup to executing your first trade, ensuring you have a clear understanding of the platform and its functionalities.

How to Trade Spot on Binance (Web)

A spot trade is a simple transaction between a buyer and a seller to trade at the current market rate, known as the spot price. The trade takes place immediately when the order is fulfilled.Users can prepare spot trades in advance to trigger when a specific (better) spot price is reached, known as a limit order. You can make spot trades on Binance through our trading page interface.

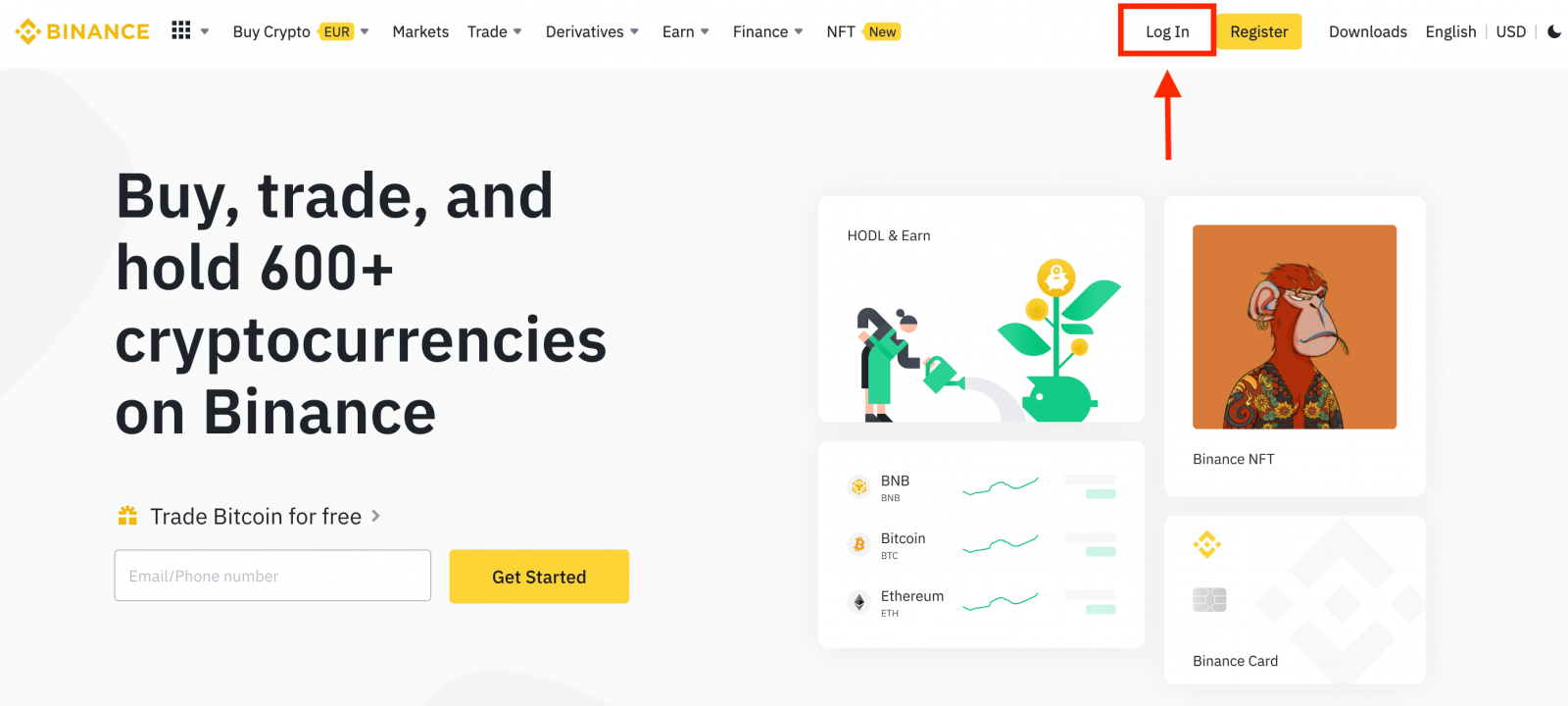

1. Visit our Binance website, and click on [Log in] at the top right of the page to log into your Binance account.

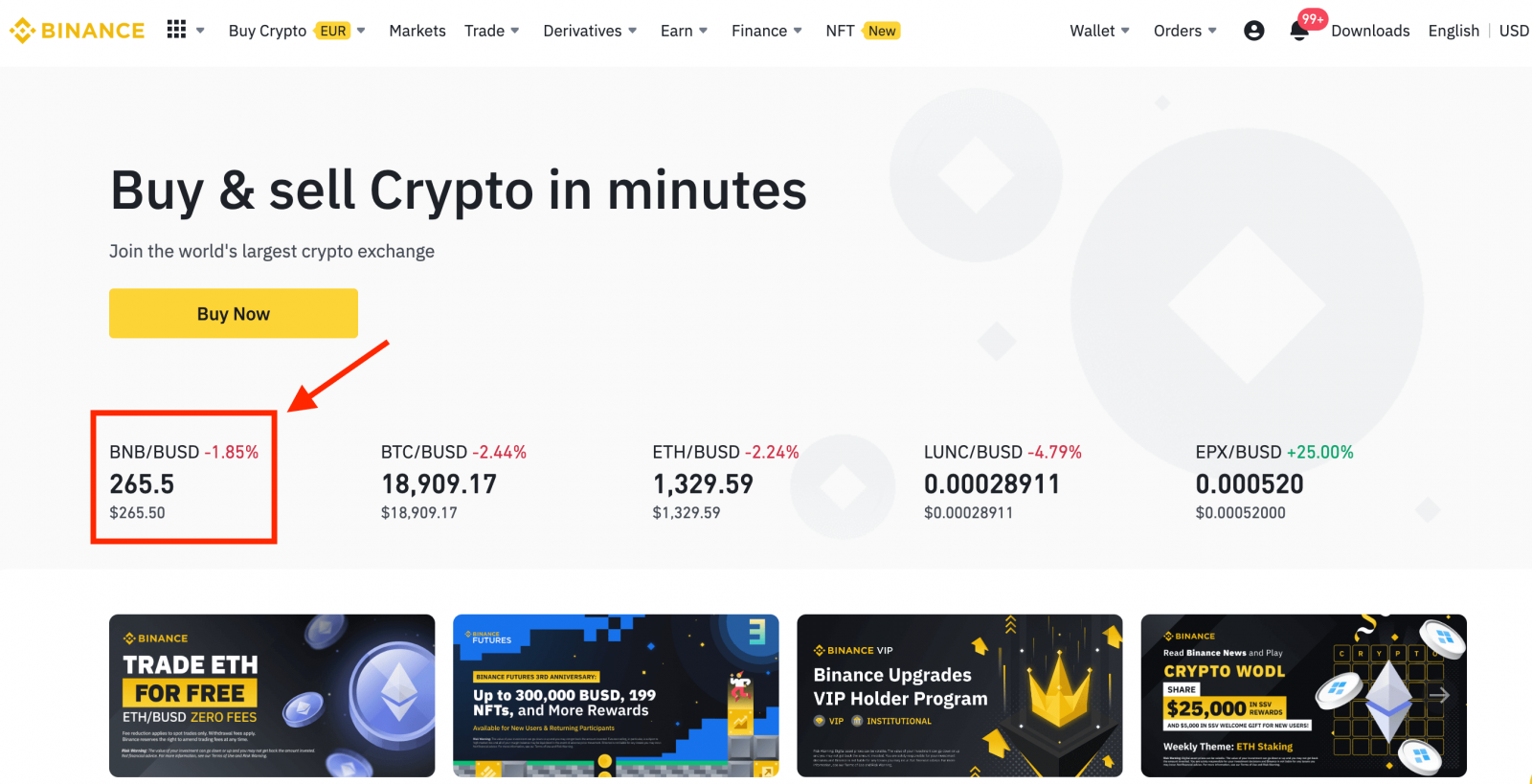

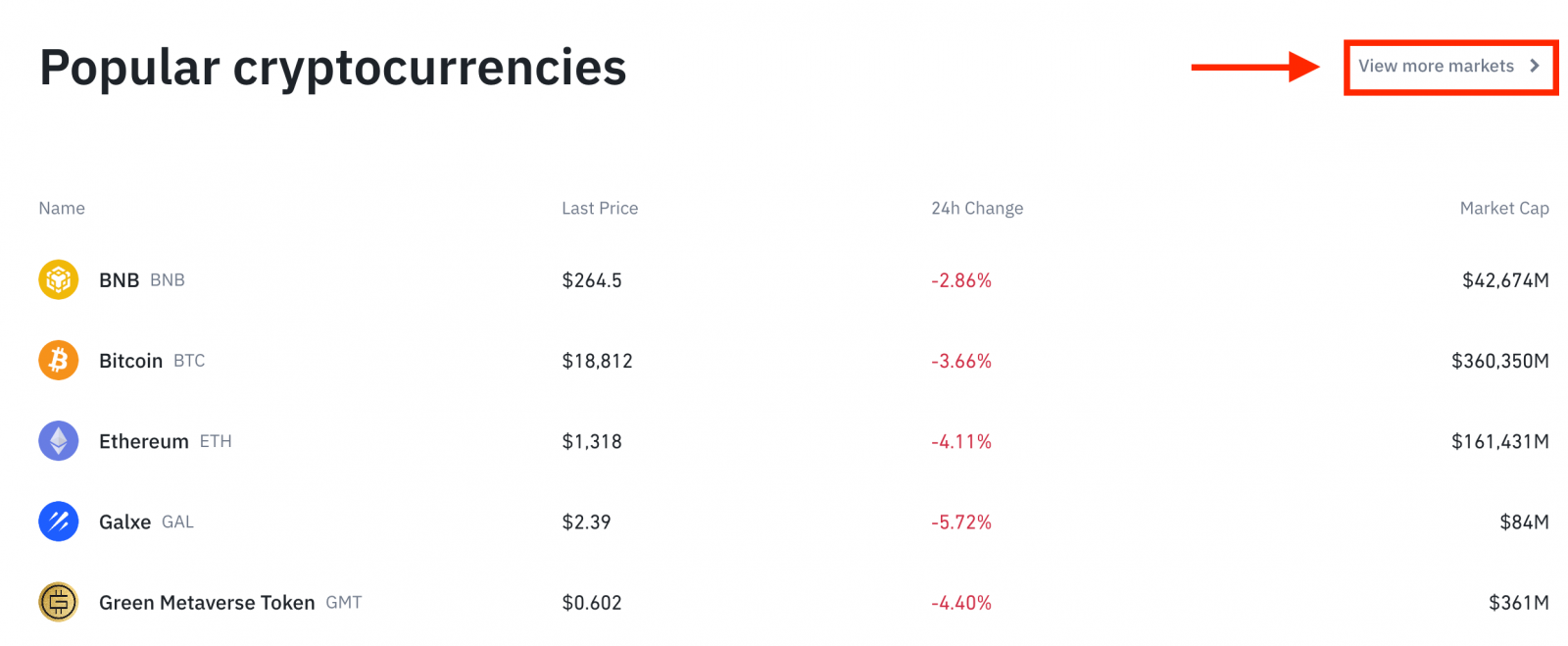

2. Click on any cryptocurrency on the home page to go directly to the corresponding spot trading page.

You can find a larger selection by clicking [View more markets] at the bottom of the list.

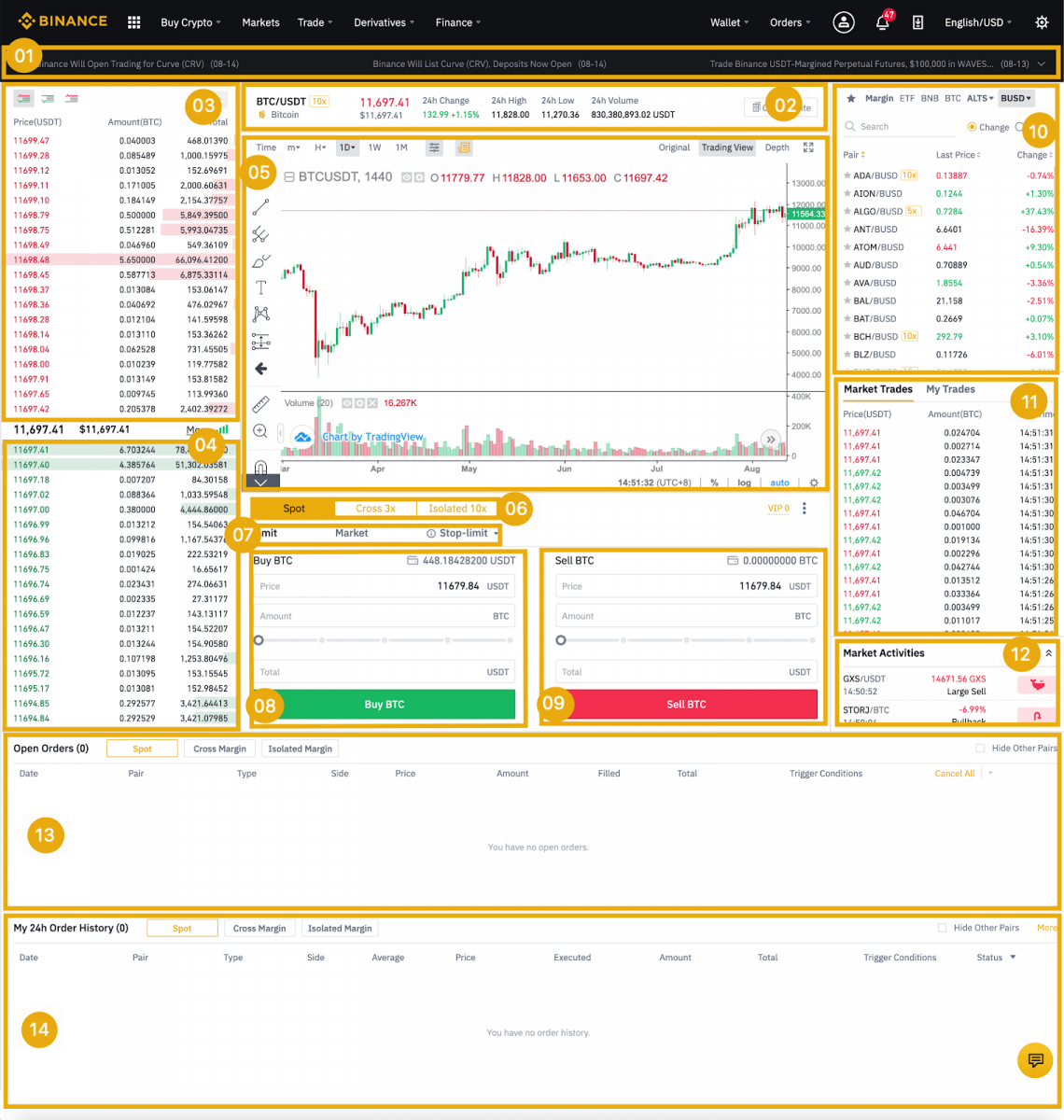

3. You will now find yourself on the trading page interface.

- Binance Announcements

- Trading volume of the trading pair in 24 hours

- Sell order book

- Buy order book

- Candlestick chart and Market Depth

- Trading Type: Spot/Cross Margin/Isolated Margin

- Type of order: Limit/Market/Stop-limit/OCO(One-Cancels-the-Other)

- Buy Cryptocurrency

- Sell Cryptocurrency

- Market and Trading pairs.

- Your latest completed transaction

- Market Activities: large fluctuation/activities in market trading

- Open orders

- Your 24h order history

- Binance customer service

4. Let’s look at buying some BNB. At the top of the Binance home page, click on the [Trade] option and select or [Classic] or [Advanced].

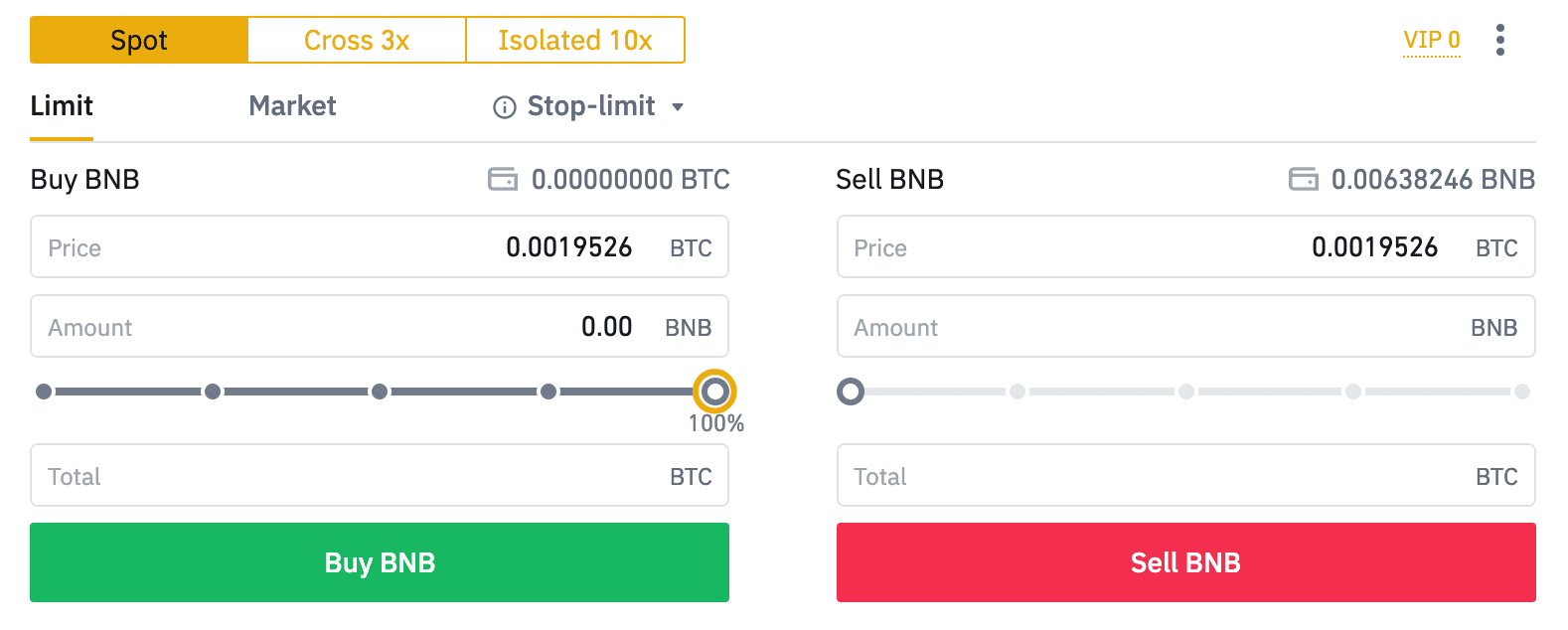

Go to the buying section (8) to buy BNB and fill in the price and the amount for your order. Click on [Buy BNB] to complete the transaction.

You can follow the same steps to sell BNB.

- The default order type is a limit order. If traders want to place an order as soon as possible, they may switch to [Market] Order. By choosing a market order, users can trade instantly at the current market price.

- If the market price of BNB/BTC is at 0.002, but you want to buy at a specific price, for example, 0.001, you can place a [Limit] order. When the market price reaches your set price, your placed order will be executed.

- The percentages shown below the BNB [Amount] field refer to the percentage amount of your held BTC you wish to trade for BNB. Pull the slider across to change the desired amount.

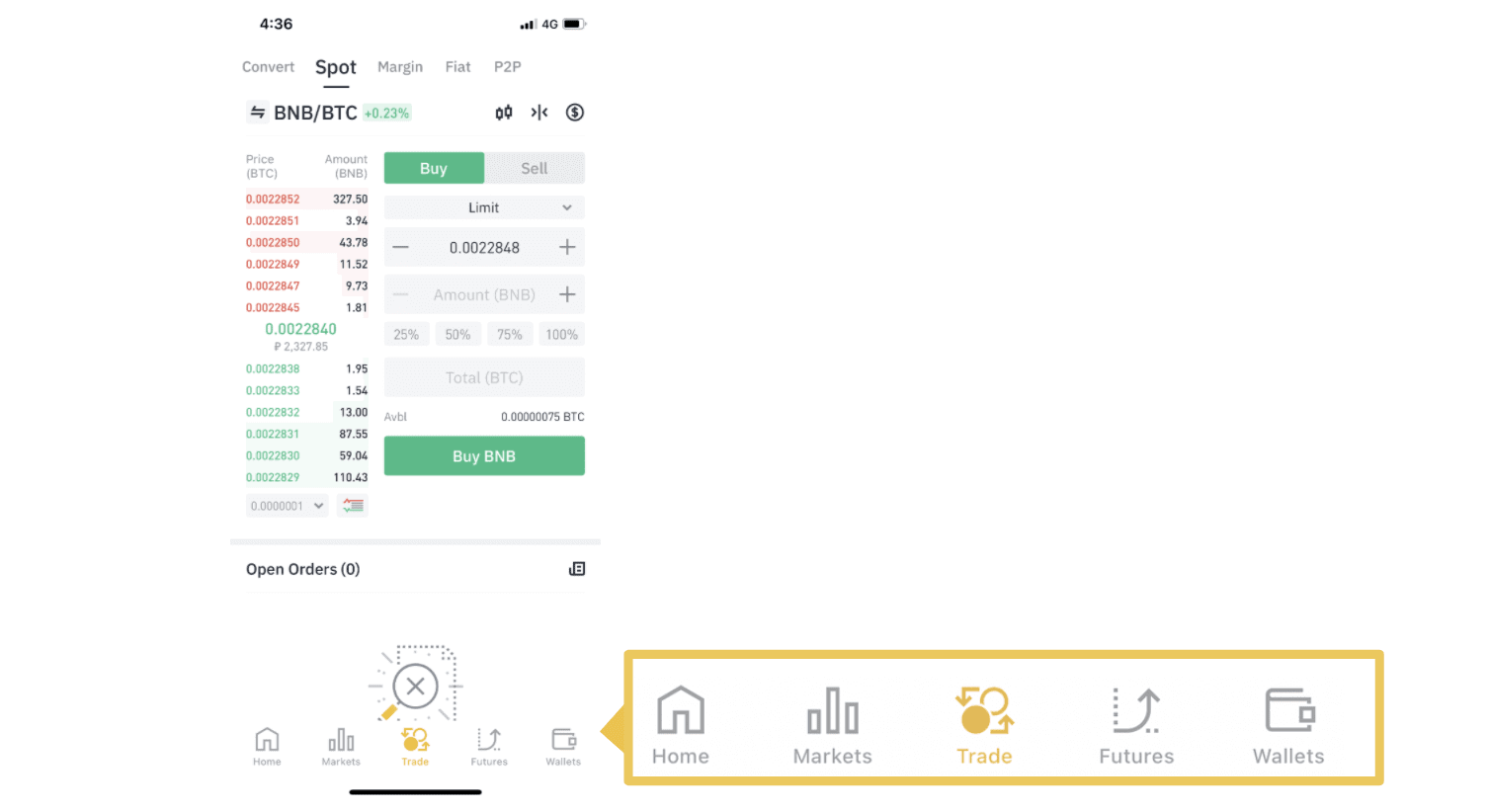

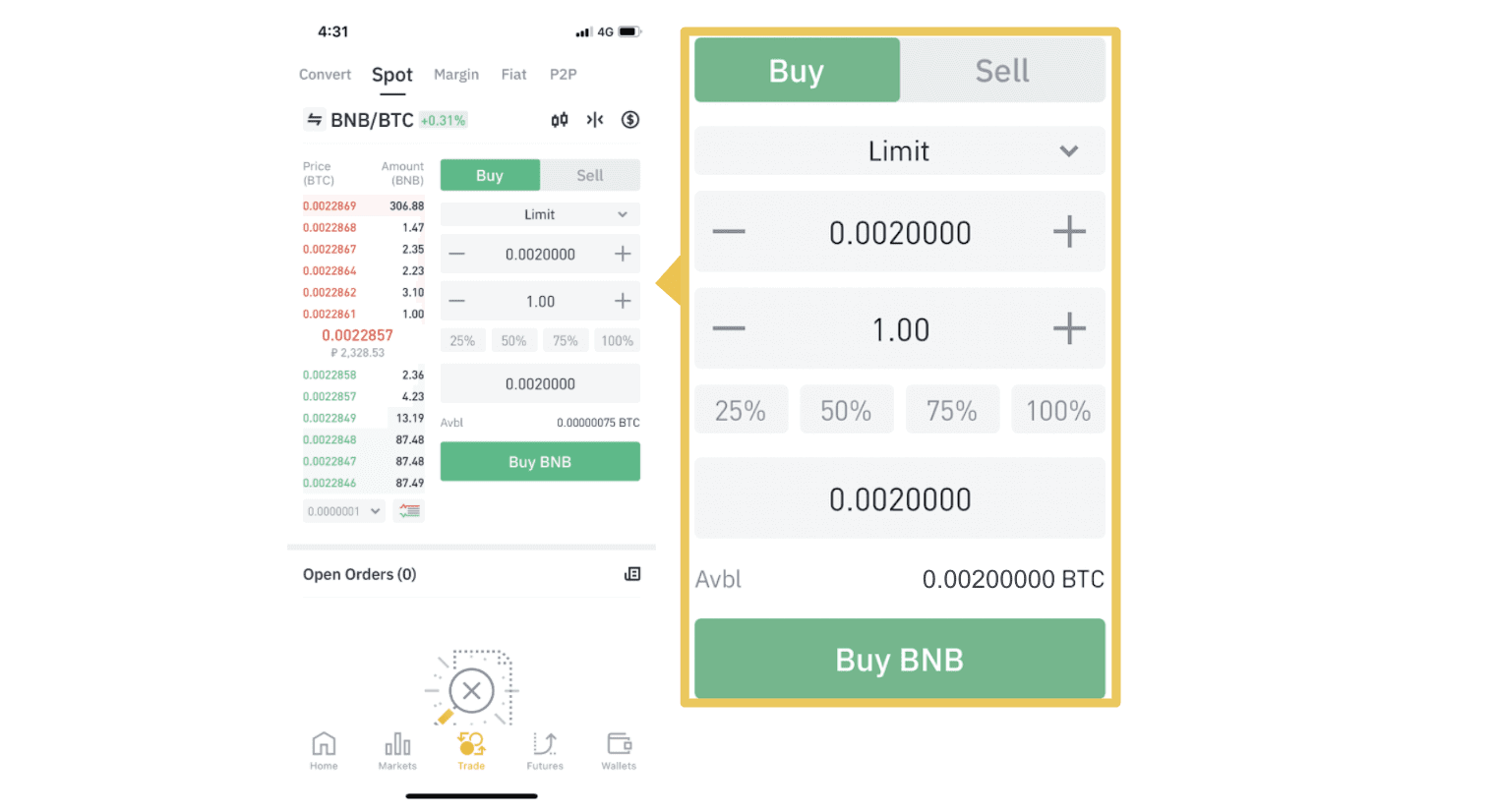

How to Trade Spot on Binance (App)

1. Log in to the Binance App, and click on [Trade] to go to the spot trading page.

2. Here is the trading page interface.

1. Market and Trading pairs.

2. Real-time market candlestick chart, supported trading pairs of the cryptocurrency, “Buy Crypto” section.

3. Sell/Buy order book.

4. Buy/Sell Cryptocurrency.

5. Open orders.

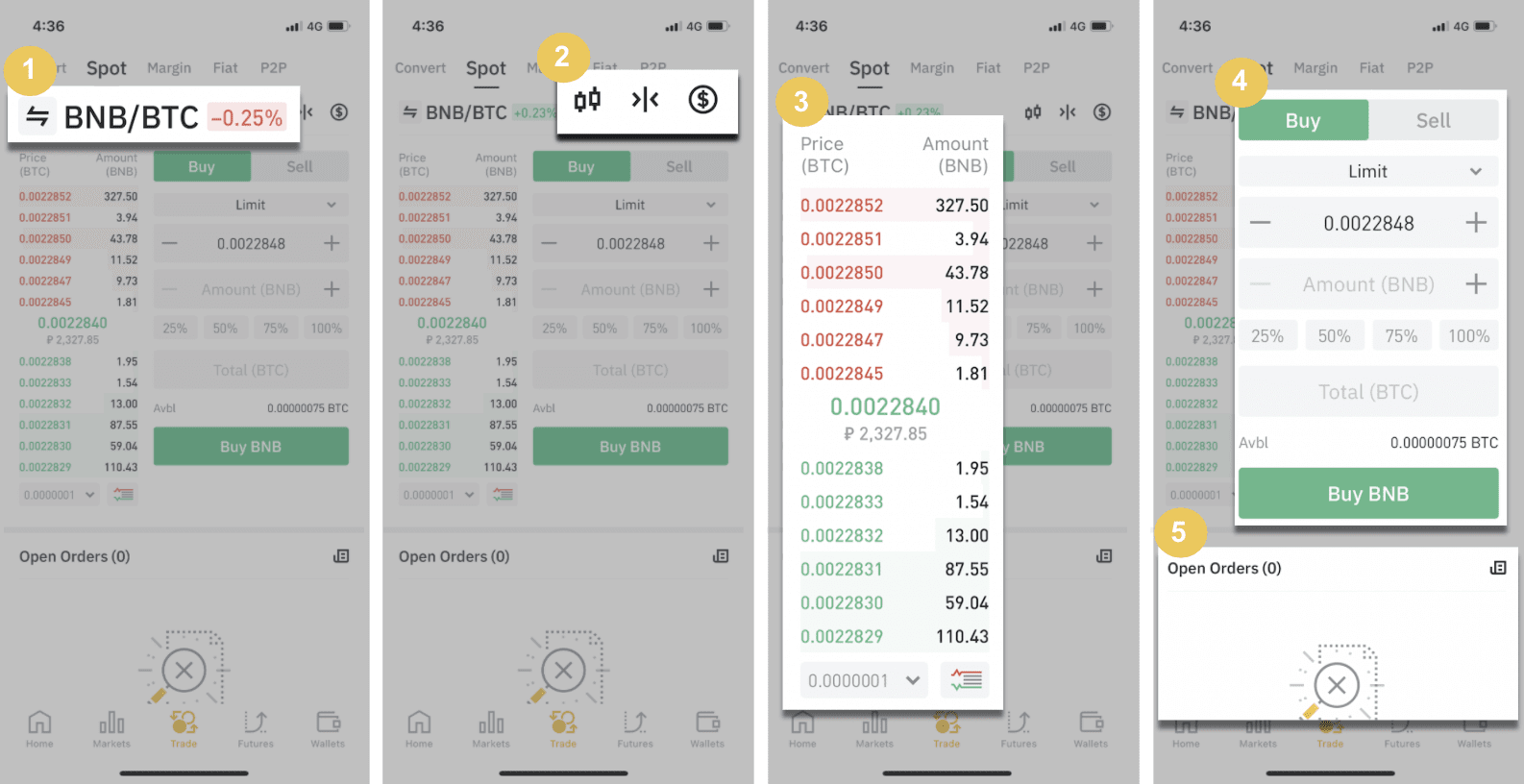

As an example, we will make a "Limit order" trade to buy BNB

(1). Input the spot price you wish to buy your BNB for and that will trigger the limit order. We have set this as 0.002 BTC per BNB.

(2). In the [Amount] field, input the amount of BNB you wish to purchase. You may also use the percentages underneath to select how much of your held BTC you want to use to buy BNB.

(3). Once the market price of BNB reaches 0.002 BTC, the limit order will trigger and complete. 1 BNB will be sent to your spot wallet.

You can follow the same steps to sell BNB or any other chosen cryptocurrency by selecting the [Sell] tab.

You can follow the same steps to sell BNB or any other chosen cryptocurrency by selecting the [Sell] tab.NOTE:

- The default order type is a limit order. If traders want to place an order as soon as possible, they may switch to [Market] Order. By choosing a market order, users can trade instantly at the current market price.

- If the market price of BNB/BTC is at 0.002, but you want to buy at a specific price, for example, 0.001, you can place a [Limit] order. When the market price reaches your set price, your placed order will be executed.

- The percentages shown below the BNB [Amount] field refer to the percentage amount of your held BTC you wish to trade for BNB. Pull the slider across to change the desired amount.

What is the Stop-Limit Function and How to use it

What is a stop-limit order

A stop-limit order is a limit order that has a limit price and a stop price. When the stop price is reached, the limit order will be placed on the order book. Once the limit price is reached, the limit order will be executed.

- Stop price: When the asset’s price reaches the stop price, the stop-limit order is executed to buy or sell the asset at the limit price or better.

- Limit price: The selected (or potentially better) price at which the stop-limit order is executed.

You can set the stop price and limit price at the same price. However, it’s recommended that the stop price for sell orders should be slightly higher than the limit price. This price difference will allow for a safety gap in price between the time the order is triggered and when it is fulfilled. You can set the stop price slightly lower than the limit price for buy orders. This will also reduce the risk of your order not being fulfilled.

Please note that after the market price reaches your limit price, your order will be executed as a limit order. If you set the stop-loss limit too high or the take-profit limit too low, your order may never be filled because the market price cannot reach the limit price you set.

How to create a stop-limit order

How does a stop-limit order work?

The current price is 2,400 (A). You can set the stop price above the current price, such as 3,000 (B), or below the current price, such as 1,500 (C). Once the price goes up to 3,000 (B) or drops to 1,500 (C), the stop-limit order will be triggered, and the limit order will be automatically placed on the order book.

Note

-

Limit price can be set above or below the stop price for both buy and sell orders. For example, stop price B can be placed along with a lower limit price B1 or a higher limit price B2.

-

A limit order is invalid before the stop price is triggered, including when the limit price is reached ahead of the stop price.

-

When the stop price is reached, it only indicates that a limit order is activated and will be submitted to the order book, rather than the limit order being filled immediately. The limit order will be executed according to its own rules.

How to place a stop-limit order on Binance?

1. Log in to your Binance account and go to [Trade] - [Spot]. Select either [Buy] or [Sell], then click [Stop-limit].

2. Enter the stop price, limit price, and the amount of crypto you wish to purchase. Click [Buy BNB] to confirm the details of the transaction.

How to view my stop-limit orders?

Once you submit the orders, you can view and edit your stop-limit orders under [Open Orders].

To view executed or canceled orders, go to the [Order History] tab.

Frequently Asked Questions (FAQ)

What is a Limit Order

A limit order is an order that you place on the order book with a specific limit price. It will not be executed immediately like a market order. Instead, the limit order will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to buy at a lower price or sell at a higher price than the current market price.

For example, you place a buy limit order for 1 BTC at $60,000, and the current BTC price is 50,000. Your limit order will be filled immediately at $50,000, as it is a better price than the one you set ($60,000).

Similarly, if you place a sell limit order for 1 BTC at $40,000 and the current BTC price is $50,000. The order will be filled immediately at $50,000 because it is a better price than $40,000.

| Market Order | Limit Order |

| Purchases an asset at the market price | Purchases an asset at a set price or better |

| Fills immediately | Fills only at the limit order’s price or better |

| Manual | Can be set in advance |

What is Market Order

A market order is executed at the current market price as quickly as possible when you place the order. You can use it to place both buy and sell orders.

You can select [Amount] or [Total] to place a buy or sell market order. For example, if you want to buy a certain quantity of BTC, you can enter the amount directly. But if you want to buy BTC with a certain amount of funds, such as 10,000 USDT, you can use [Total] to place the buy order.

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:- Order date

- Trading pair

- Order type

- Order price

- Order amount

- Filled %

- Total amount

- Trigger conditions (if any)

To display current open orders only, check the [Hide Other Pairs] box.

To cancel all open orders on the current tab, click [Cancel All] and select the type of orders to cancel.

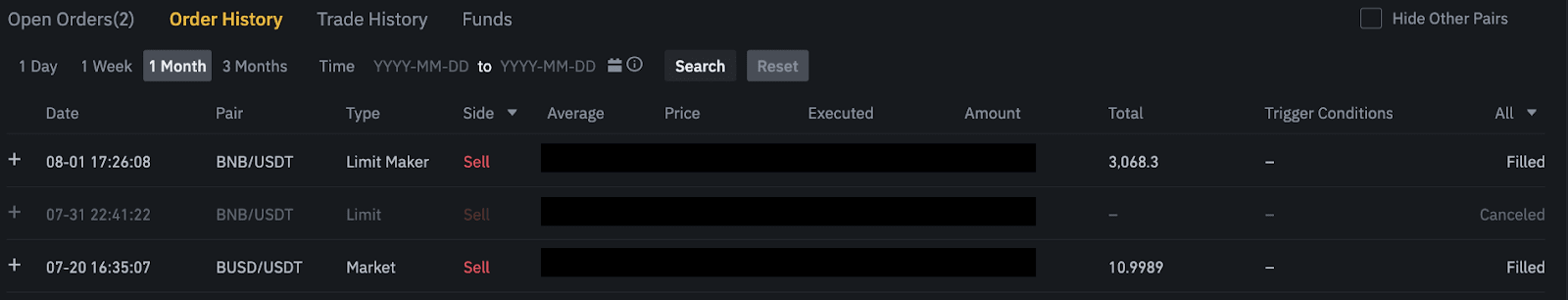

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:- Order date

- Trading pair

- Order type

- Order price

- Filled order amount

- Filled %

- Total amount

- Trigger conditions (if any)

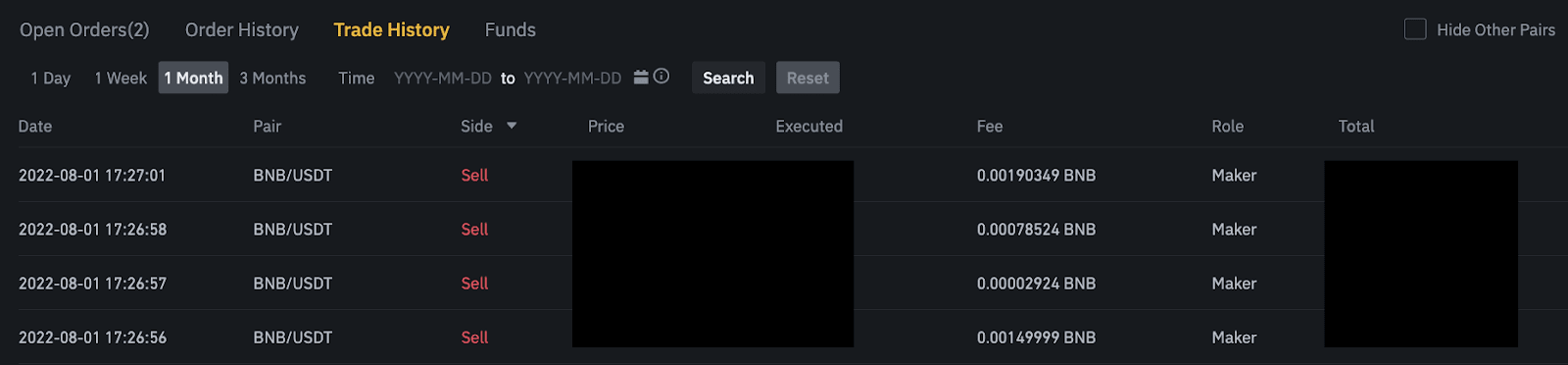

3. Trade history

Trade history shows a record of your filled orders over a given period. You can also check the transaction fees and your role (market maker or taker).To view trade history, use the filters to customize the dates and click [Search].

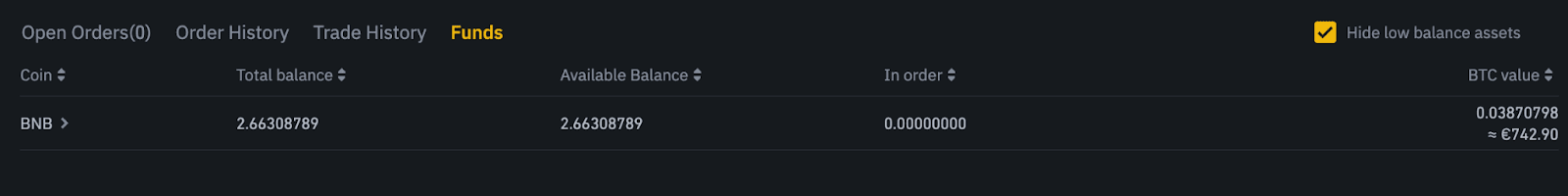

4. Funds

You can view details of the available assets in your Spot Wallet, including the coin, total balance, available balance, funds in order, and the estimated BTC/fiat value.

Please note that the available balance refers to the amount of funds you can use to place orders.

Conclusion: Mastering Crypto Trading on Binance

Trading on Binance offers a versatile and secure environment for cryptocurrency enthusiasts. By following these steps—from setting up your account and funding it to choosing the right trading pair and managing your trades—you can build a solid foundation for your trading journey.Remember, continuous learning and staying updated with market trends are key to mastering crypto trading. Enjoy the process, stay disciplined, and leverage Binance’s powerful tools to enhance your trading strategies.